Norway’s aquaculture tax’s impacts

February 21, 2023

By Matt Jones

Observers are curious to see what impacts the tax will have on the North American industry.

Cornell University’s Dr. Michael Timmons said that if Norway moves forward with a proposed 40 percent resource tax on salmon and trout farms that it would be a disaster for Norway and an opportunity for the North American market.

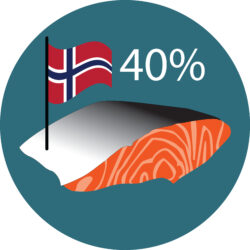

Cornell University’s Dr. Michael Timmons said that if Norway moves forward with a proposed 40 percent resource tax on salmon and trout farms that it would be a disaster for Norway and an opportunity for the North American market. In September, Norway’s government proposed the introduction of a 40 percent “ground rent” tax on salmon and trout farming companies. Norway’s government, a coalition of the Labour Party and the Center Party, says the resource tax will ensure that ‘more of the value created should go back to society’ with municipalities that are close to fish farms benefiting the most. The Norwegian Finance Ministry says that most salmon farmers will not pay the tax, only the top producers.

An official vote on the measure isn’t expected until March or April, and the exact amount of the tax has not yet been finalized – stock market analysts speculated in January that the final rate would be closer to 15 percent, while a representative of the government’s budget partner, the Socialist Left Party, downplayed those expectations. However, speculation on what the measure will mean for the aquaculture industry has run rampant.

Norwegian aquaculture companies in many cases appear to be preparing for the worst, as several have announced layoffs and some large-scale projects have been cancelled. Elsewhere, some observers are curious to see what impacts the tax will have on the North American industry.

POTENTIAL COPYCATS

One concern is that North American governments might decide to follow suit and introduce their own resource taxes on domestic industries. A representative for Canada’s Department of Fisheries and Oceans, the lead regulator for the industry in British Columbia and Price Edward Island, stated that the department is not considering similar measures to those proposed in Norway, but others remain unconvinced. Professor Michael Timmons of Cornell University, who specializes in a variety of aquaculture topics including responsible development and business management, scoffed at the suggestion that the Biden and Trudeau governments’ neo-liberal business-friendly approaches might prevent them from introducing such a tax.

“I say it’s almost probable, with elected officials. I think it’s almost for certain,” said Timmons. “Taxing and taxing and taxing and taxing – eventually you kill the goose.”

Timmons noted that the proposed tax is intended to achieve a societal benefit – clean air, clean water, responsible production of a food item. No one would disagree with those aims, but the question is who pays for it?

“Many people lose sight of the fact that companies have to make a profit,” said Timmons. “The first part of sustainability is that the company stays in business because if they don’t, they can’t employ anyone. As these societal benefits are ‘charged’ to the producer, that cost gets passed on to the consumer. I think with the current political climate, that the costs incurred for societal benefits are going to be passed on to private industry and then some private industry will not be able to survive.”

Newfoundland Aquaculture Industry Association Executive Director Jamie Baker feels that such a resource tax would be inadvisable in Canada, though he noted that he’ll withhold full judgement until he sees exactly how the Norwegian tax plays out.

“In Atlantic Canada we have a very solid, proven approach between regulators and producers that allows development of finfish and shellfish aquaculture in a responsible manner while providing maximum benefits for those adjacent to the farms,” said Baker. “Aquaculture in this region is a huge positive contributor to the public good by way of economics, low-carbon food production, job creation in rural and coastal areas, Indigenous business and opportunities development and much more. In addition to the benefits, the approach in this region also ensures a very high level of social and environmental responsibility for companies and stakeholders developing any marine resource.”

NORWEGIAN OPERATORS LOOKING TO MOVE?

Another potential impact on the North American industry, if the U.S. and Canada don’t implement their own resource taxes, is the possibility that Norwegian aquaculture companies may look at moving operations to avoid paying the tax. Timmons sees that as an extremely likely outcome.

Photo: ©Gabrieuskal / Adobe Stock

“They will move according to their economic self interest, it’s very simple,” says Timmons. “About 40 percent of farmed salmon are produced in Norway, 30 percent in Canada, 20 percent are produced in Chile. And those things can move very easily.”

Ola Helge Hjetland, group communications director for Mowi ASA, noted that a 40 percent resource tax means that total tax on Norwegian aquaculture companies would be at least 63 percent. Mowi, he said, shares government’s ambitions for the industry to generate more jobs and economic opportunities in coastal communities, but the proposed tax undermines those goals and weakens the competitiveness of the Norwegian industry. While he did not say specifically if Mowi was looking to move operations elsewhere, it was heavily implied.

“Salmon farming is not bound by geography, meaning that growth that should have taken place in Norway will happen elsewhere; most likely to countries close to the main salmon markets since 97 percent of Norwegian salmon is exported,” said Hjetland. “Demand for more salmon will not just disappear. We hope the government is willing to take a step back and contribute to designing a tax model adapted to the aquaculture industry and with broad political support.”

Timmons also said that moving operations to North America could have significant benefits for Norwegian businesses. As Hjetland noted, 97 percent of Norwegian produced salmon is exported; moving operations into North American jurisdictions would present a significant reduction in transportation costs.

HOW SHOULD NORTH AMERICAN OPERATORS PREPARE?

What this means for companies that are already operating within North America, however, is that the market may become more crowded. In such an environment, its more important than ever for aquaculture companies to ensure that their operations are as efficient and responsible as possible and that their markets and relationships with their distributors and other partners are strong and well-developed.

“Embrace technologies that allow you to produce fish responsibly, sustainably and economically,” advised Timmons, who cites his own work with Recirculating Aquaculture Systems (RAS) as an example. The COVID-19 pandemic caused significant disruptions to the supply chain, making domestic production a priority in many areas. Timmons was recently recruited to work with the Kingdom of Saudi Arabia to help set up domestic production to replace all of the country’s imported freshwater seafood. He also teaches a virtual course on RAS systems, which he recommends to any aquaculture producer who is interested.

ALTERNATE APPROACHES

The resource tax is, in essence, an effort to make industry pay for the use of a natural resource in order to offset environmental and societal impacts on local communities. But there are other potential approaches. One would be, rather than implementing a ground rent tax on every company of a certain size, to implement environmental standards with much more significant penalties. As it stands currently in many different jurisdictions and industries, companies simply view fines for violations of environmental standards as a cost of doing business – a fine of millions of dollars is not much of a deterrent when the company stands to make billions off their product.

“Let the Norwegians come to a reasonable set of environmental standards that have to be met, and if you violate those there are severe penalties,” said Timmons. “Penalize the wrong doer, don’t penalize everyone.”

That being said, Timmons himself hopes that the Norwegian tax does go through – for the benefit of the North American industry.

“I’m really selfish, I’m American,” Timmons said with a laugh. “I hope Norway puts in as huge a tax as possible and they drive all the production out of there and over to Canada and the U.S. That’s what I hope. Go ahead and kill your golden goose over there. The demand for salmon is going up. If you decrease the supply, what happens to the price? It’s just simple economics. It just boggles my mind that people ignore basic economic principles.”

Advertisement

- Cooke Aquaculture named one of Atlantic Canada’s Top Employers

- Canadian RAS farmer loses stock in power outage